Stats Show that Philly is a Rising Tech Hub

Stats from the JLL Technology Office Outlook 2015 study

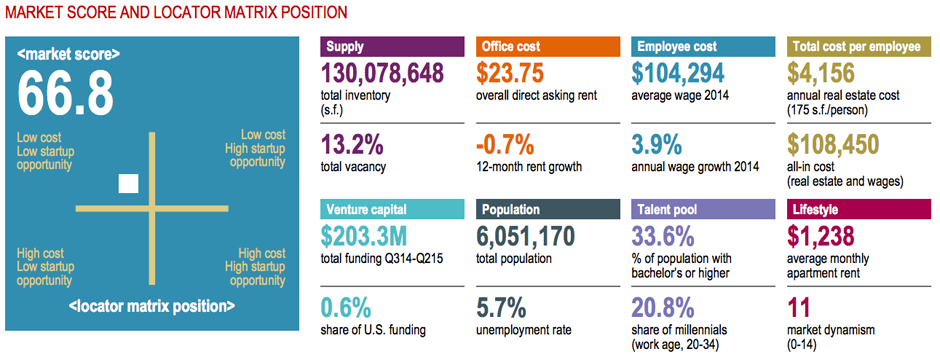

By plenty of measures, Philadelphia’s technology and startup market is growing exponentially. While it still doesn’t rival the titans like San Francisco or New York, it’s coming into its own — seeing venture capital climb nearly $85 million in just the past year. Also, tech companies are taking up more and more office space.

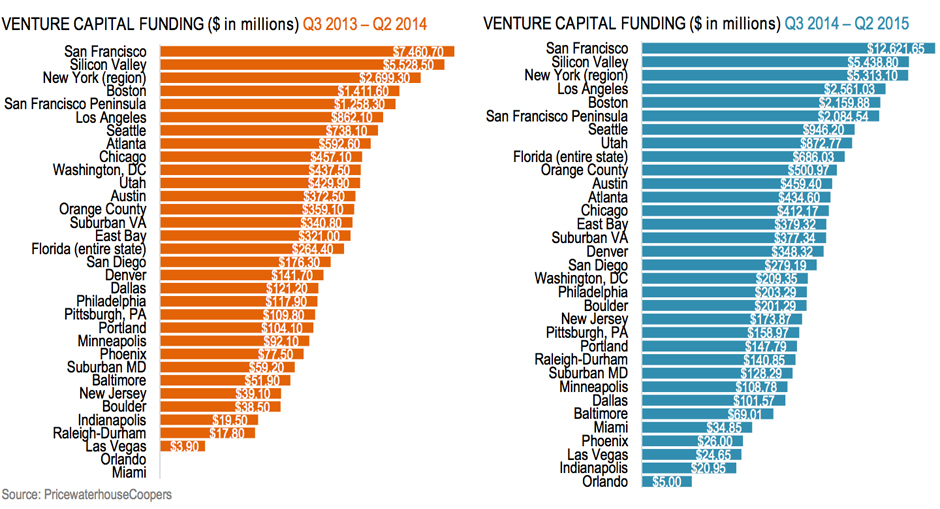

An expansive new study by JLL breaks it all down. It found that Philly companies raised $118 million in venture capital between the third quarter of 2013 and the second quarter of 2014. But that number climbed to $203 million between Q3 2014 to Q2 2015.

“That’s a pretty big jump,” said Lauren Gilchrist, vice president and director of research in the Philadelphia office of JLL. “The velocity we’re experiencing is incredible. We might not be firmly established or going gangbusters like San Francisco or New York, but the trend demonstrates an expanding community and opportunity for investment.”

This handy chart shows the VC funding growth, and where Philly ranks nationally:

Stats from the JLL Technology Office Outlook 2015 study

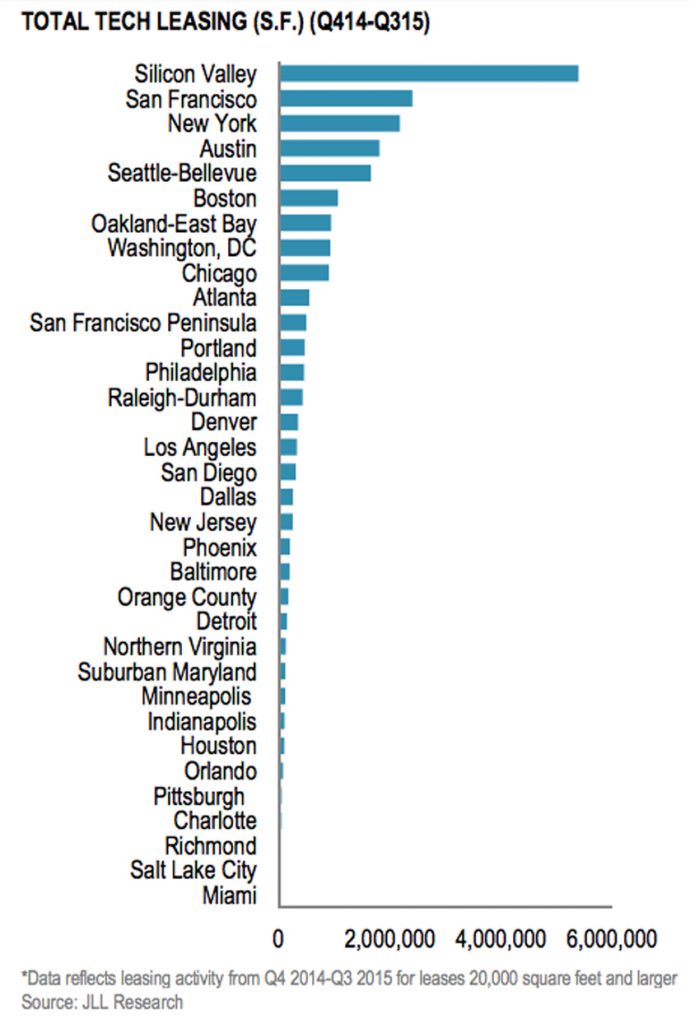

Philadelphia tech companies are occupying the 13th-most office space of any U.S. city during the period of Q4 2014 – Q3 2015, according to JLL. (JLL is a professional services and investment management company specializing in real estate. It was formerly known as Jones Lang Lasalle).

“We’re right behind Portland and ahead of Raleigh-Durham and they’re both considered really strong tech markets.”

Stats from the JLL Technology Office Outlook 2015 study

Right now, Philly is deemed a “low-cost, low startup opportunity” city, but Gilchrist said that’s primed to change.

“I see the city moving into the low-cost, high-opportunity zone as access to venture capital expands here, as Comcast expands here and as the tech community becomes more mature,” she said.

The report lauded Philly’s ability to attract more than 10,000 millennials since 2006, saying that a “burgeoning Center City tech presence has followed.” It also said that institutions like the University of Pennsylvania and Drexel University are “investing resources in innovation neighborhoods, incubation spaces and supportive infrastructure to attract VC and retain talent.”

But the report also highlighted some challenges.

“Venture investment in the region remains low despite shifting demographics and local government support. New sources of seed capital and additional angel investor activity will be needed to nurture and grow the existing pool of tech tenants. As a first-generation tech market, Philadelphia has seen relatively few companies exit the startup life-cycle, freeing up talent and funding for second-round ventures.”

Like what you’re reading? Stay in touch with BizPhilly — here’s how:

- Follow BizPhilly on Twitter and follow editor Jared Shelly here.

- Get the BizPhilly Newsletter

- Like BizPhilly on Facebook

- Check out the BizPhilly homepage