How Much of Your Monthly Income Should Be Spent on Rent?

We’ve all heard the different calculations: You’ll need to spend a third of your salary on rent. Or don’t spend more than half. No, it’s actually half of your gross, but a third of your net.

Write out a monthly budget, and you’ll still be stymied by the question of utilities (included or no?) and the inevitable unexpected, which may be an oxymoron but is nonetheless accurate.

One reader told us he never worries about the precise number of his rent because, without student loan debt or credit card debt, he only has to worry about immediate expenses. But those expenses fluctuate. Have a romantic partner? Binging on Arrested Development rather than hitting a bar every night for a few beers is cheaper.

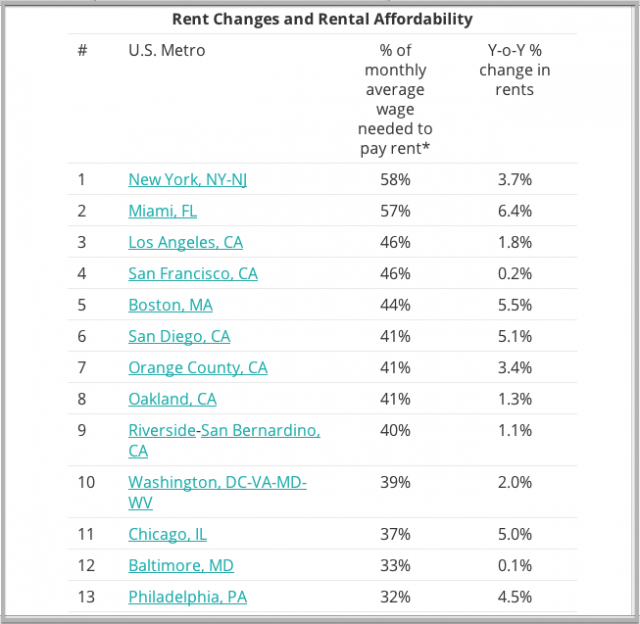

Fortunately, Trulia Trends tracks rental changes and affordability across the country’s largest metros. Below, a current look at where Philly fits in with expenditures. As usual, compared to New York, we’re sittin’ pretty at 32 percent. But look for this to increase: Philly is one of just two big cities (the other is Houston) where rent is rising faster than prices.

Rising Prices Make Homeownership Affordability More Unequal Across the U.S.[Trulia Trends]