Philadelphia Venture Capital Status? Perfectly Mediocre

Last November, Mayor Nutter announced a batch of grants for local entrepreneurs, funded through StartUp PHL—the joint venture between the Commerce Department, Philadelphia Industrial Development Corporation and Josh Kopelman’s First Round Capital. StartUp PHL—the city’s main pipeline of support to the city’s entrepreneurial community—has contributed more than $1 million in seed funding or angel investments to local startups since its inception two and a half years ago. “For Philadelphia to continue to grow we must be a city that welcomes exciting, innovative companies and the type of talented workforce that wants to work for those companies,” Nutter said, in announcing the latest grants.

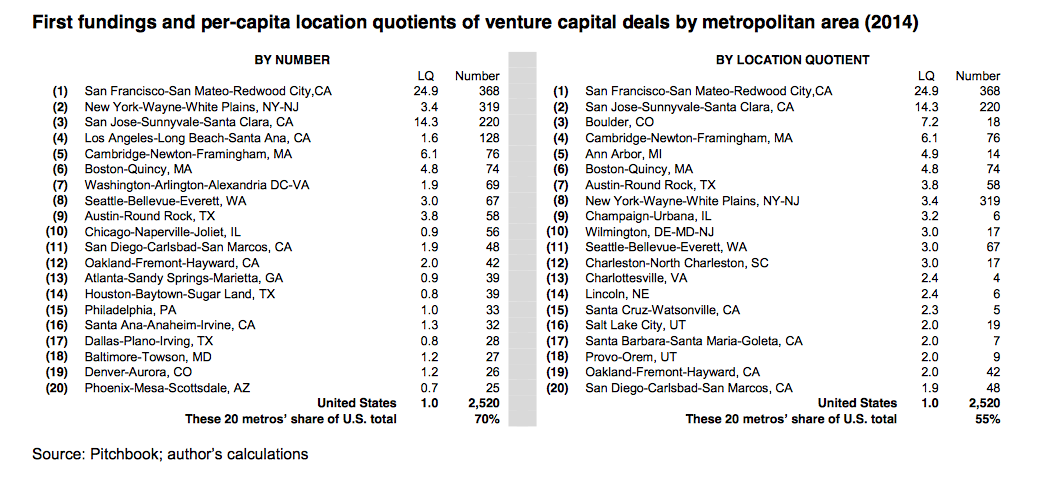

But to breed an urban-tech community of startups, you need lots of private investment—a lot more cash than StartUp PHL can provide. And there’s new research out showing that Philly remains something of a laggard in attracting private capital for its startups. A senior fellow at Brookings compiled data on “first fundings”—the initial round of venture capital for new companies—in metro areas of more than 100,000 people nationwide. In the report, there’s good news and bad news for Philadelphia.

The good news is that we rank fifteenth for the total number of early-stage funding deals among all metros in 2014. The bad news is that Philly’s “location quotient” is 1.0, meaning our density for startup funding is perfectly mediocre:

“A metro area with a location quotient of 1 has the same first-funding density (deals per capita) as the entire United States, while metros with values greater or less than 1 have densities higher or lower than the nation as a whole.”

That being said, the city still outperformed Chicago, Atlanta and Houston in per capita venture funding last year (we also trailed Baltimore, Wilmington and Denver). At the top of this list were usual suspects San Francisco, San Jose and Cambridge.

There’s some reason to think Philly’s venture capital capacity may be improving. A study by Richard Florida’s Martin Prosperity Institute ranked Philly at 11th overall for gross VC investment in 2012, and suggested we’re gaining steam. And between 2009 and 2013, there was a 42 percent increase in the number of VC deals closed within our area.

And Technical.ly Philly reports that the much-maligned business regulations in this city appear to be improving, at least for startups. In 2008, a change of tax code in the Revenue Department, followed by a 2012 piece of legislation sponsored by Bill Green, has created a new world in which investment funds (especially venture capitalists) are eligible for fewer taxes. As Technical.ly Philly put it:

Now, clear as day, if you look to move your venture capital firm to the city, you know that the funds you manage and the percentage-based management fees you receive are not subject to municipal business tax, as is the case in much of the country.

It may take time—maybe even a decade—for the results of those tweaks to materialize in a first-round funding boom. But nationwide, VC is diversifying away from California, and clustering in more urban-tech centers. DuckDuckGo, Scholly, ChargeItSpot—all startups that began in our backyard, before receiving national acclaim. Here’s hoping there are many more to come.