A Breakdown of Where Philly’s $12 Million in Investment Cash is Going

Led by Honeygrow and ChargeItSpot, Philadelphia has gotten some serious venture capital funding in the second quarter of 2015. In fact, restaurant chain Honeygrow raised the most cash in the quarter — $5 million — which is part of a larger $25 million investment that will bring more locations and upgraded technology to the business. Will it be the next Shake Shack or Chipotle? It’s certainly part of a wave of Philly restaurants attempting to become the next great chain. (We examine the phenomenon here.)

Meanwhile ChargeItSpot raised nearly $4.1 million in the quarter. The company provides free cell phone lockers with virtually any charger, so you can charge your phone on the go. (It was a lifesaver for me once at the Cherry Hill Mall.)

There were plenty of impressive raises during the second quarter. Here’s a list:

| Company | VC Funding |

|---|---|

| Honeygrow Restaurant Organization LP | $5,000,000 |

| ChargeItSpot LLC | $4,089,200 |

| GSI Health LLC | $1,500,000 |

| LifeVest Health | $500,000 |

| Biobots | $250,000 |

| Grand Round Table Inc | $250,000 |

| Yorn LLC | $100,000 |

| UE LifeSciences Inc | $78,800 |

| Optofluidics Inc | $75,000 |

| ROAR for Good LLC | $75,000 |

| DECNUT | $50,000 |

| Bungalow Insurance LLC | $25,000 |

| LIA Diagnostics Inc | $25,000 |

| LocoRobo Inc | $25,000 |

| StayWanderful | $25,000 |

| Untapped Inc | $25,000 |

| Total | $12.1 million |

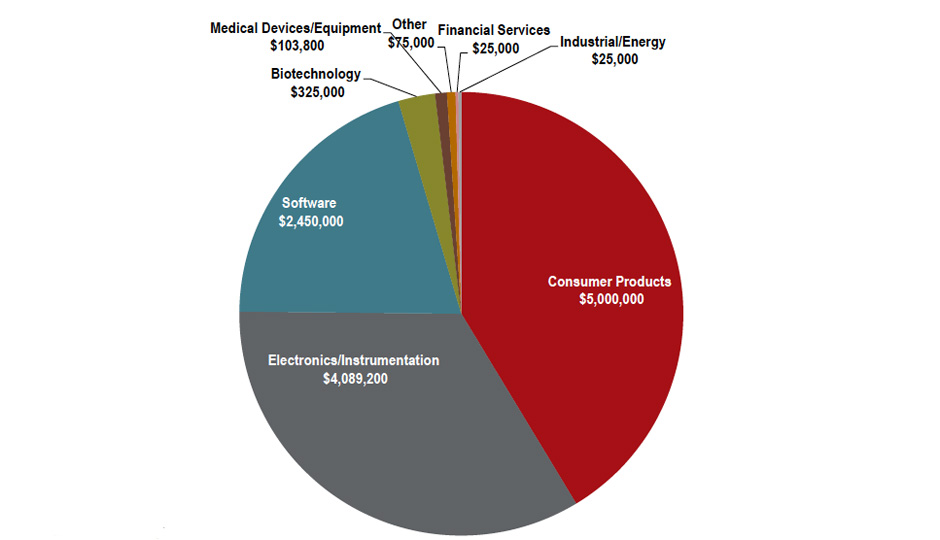

Those venture capital raises came in a multitude of different industries, but consumer products was by far and away the leader at $5 million. Here’s how it breaks down by industry.

Source: JLL Research, PwC Moneytree, the National Venture Association with data from Thomson Reuters.