This Local Organization Helps Low-Income Families Afford Private School. Here’s How To Support Them.

What does a family living in an under-resourced neighborhood in Philly dream of? For many, it’s a quality education for their kids and a pathway to long-term success.

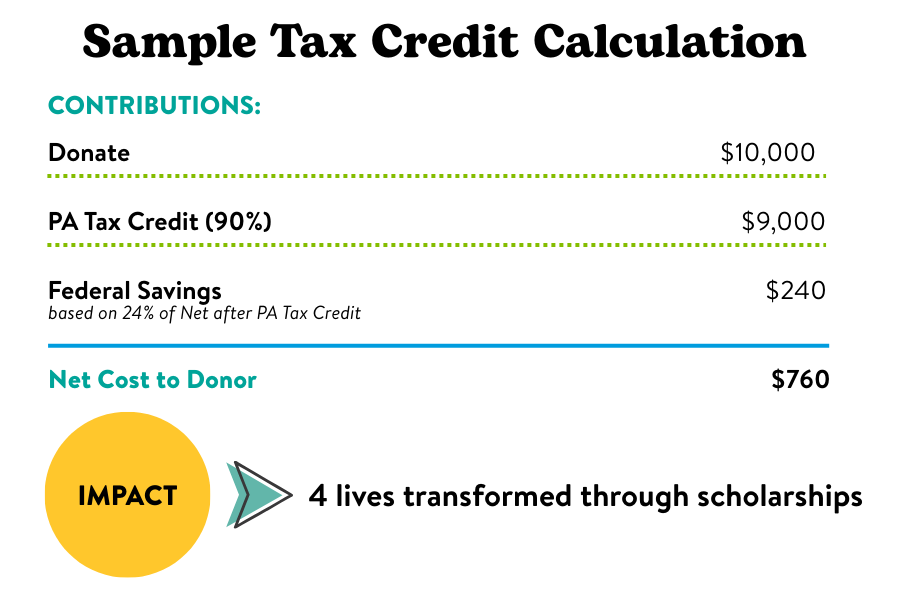

The Pennsylvania Educational Improvement Tax Credit and Opportunity Scholarship Tax Credit (EITC/OSTC) programs help make that dream a reality. Businesses and individuals can redirect their Pennsylvania state taxes into life-changing scholarships for Philly kids. Donors receive 90% (dollar-for-dollar) of their PA tax credits for donations, along with the opportunity for a small federal deduction.

Businesses and Individuals can take advantage of the program.

Who is eligible?

- Individuals or households with a PA tax liability

- Corporations and partnerships authorized to do business in PA

- Owners of shares in a corporation that conducts business in PA

CSFP makes the process easy for you.

The CSFP team helps manage the process and supplies tax documents to prove your contribution and claim your credits. The steps to get involved are simple.

-

1. Consult with a tax professional to determine desired tax credits.

2. Reach out to CSFP and initiate the tax credit donation process.

3. Donate to CSFP and change a Philly kid’s life.

4. Claim your credits and reduce your state taxes by 90% of your donation.

CSFP’s average scholarship is $2,320. A $10,000 donation yields $9,000 in 2025 PA tax credits and funds scholarships for four Philly kids in need.

Why support CSFP?

Since 2001, Children’s Scholarship Fund Philadelphia (CSFP) has provided educational access and opportunity through scholarships to Philadelphia students from under-resourced families. CSFP is Pennsylvania’s largest and most diverse K-8 scholarship program, and the organization’s need-based scholarships are awarded by random lottery, ensuring that CSFP serves students from every corner of Philadelphia.

CSFP families make sacrifices to send their children to schools of choice, but they need help from philanthropic individuals to be able to afford the increasing cost of tuition. Families in the program earn a median household income of $43,000, and two out of three families live in Philadelphia’s lowest-performing school catchment zones. For families seeking alternate educational options, scholarships are crucial and impactful.

Scholarships Work

Each year, hundreds of 8th grade students graduate from CSFP’s program, and 95% of students attended high schools of choice (i.e., schools outside of their neighborhood catchment zones). After high school, CSFP scholars go on to attend college, enroll in a trade, or participate in military service.

A quality educational foundation sets students up for long-term success, and CSFP believes that investing in the early years, allows students to thrive later in life. With the transformative power of tax credits, you can help CSFP open doors to educational opportunity for thousands of students.

Contact us to learn how you can make a contribution today!

This post was produced and paid for by Children's Scholarship Fund Philadelphia