Mayor Kenney Should Embrace the Republican Tax Plan

Corporate tax relief would increase jobs and decrease the city’s tax burden – and that’s a good thing.

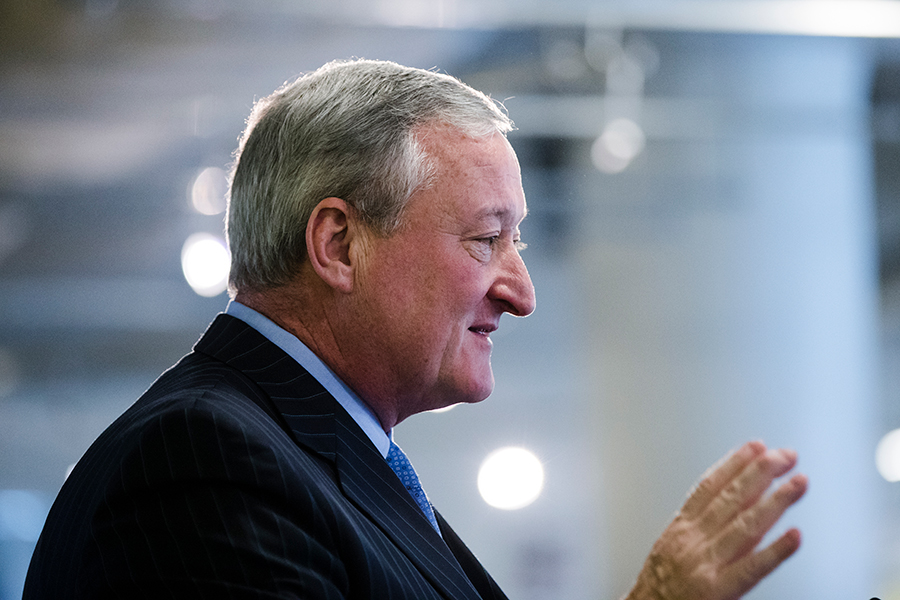

Photo by Matt Rourke/AP

I’m a fan of Jim Kenney’s and voted for him. But on taxes, we are not on the same page.

That’s because I believe, unlike him, that the finalized tax reform bill to be voted on by both the House and Senate next week before being turned over to the president for his signature will be a good thing for Philadelphia — and the country. It will increase jobs and reduce our city’s tax burden.

Let me offer a few reasons why.

The mayor lamented in a recent commentary in the Philadelphia Inquirer the loss or scaling back of key deductions — like the deduction for local and property taxes — writing that “approximately 30 percent of Philadelphia residents use this deduction with an average savings of $3,400.” Who knew the mayor was such a friend of the wealthy? C’mon — who else is getting that kind of deduction? First of all, the plan allows the first $10,000 of these taxes to be deducted. More notably, a significant number of those residents who are paying more than $10,000 likely own properties in Society Hill and Rittenhouse Square. Trust me, they’ll be fine.

As for the other 70 percent of city residents who aren’t affected, they’ll be pleased to know that they’ll benefit from the doubling — yes, doubling — of the standard deduction from $12,000 for a married couple filing jointly to $24,000 per year. Many taxpayers filing individually or jointly will see their rates to decline to anywhere from 12 to 25 percent on incomes up to $250,000.

No, this bill is not a “slap in the face to middle class Philadelphians and all working families,” as the mayor says. Even with the loss of some deductions, the bill is a tax cut for most Americans. But here’s the reality: This bill was never meant to be a middle-class tax cut. It’s meant to be a corporate tax cut. And that’s a good thing for Philadelphia! Why?

The final bill would cut corporate rates to a level (21 percent from 35 percent) that hasn’t been seen in decades. It would offer a special rate for companies to repatriate cash held overseas back to the U.S. It would lower the tax burden (a deduction for the first 20 percent of income) on thousands of small businesses in the city that are “pass-through” entities. It would a create friendlier tax environment for foreign companies to move to this area, build factories, and invest in our region. What does this all mean?

Jobs for Philadelphians. Revenues to the city and the state. One public policy economics firm predicts that an estimated 179,142 jobs will be created in Pennsylvania, along with an increase in wages by $7,743,417,200. I know … economists. But still.

The tax savings would help our merchants, service providers, and restaurateurs offset higher costs brought on by current and future regulations on minimum wages, healthcare coverages, childcare for employees, and the city-mandated paid-time-off laws. Companies with more money will invest in equipment, technology, property, and other capital items, all of which generate business for their suppliers, vendors, and contractors — and compensation for their employees too.

Some say companies won’t invest. OK, let’s go with that. Because even if these companies stick their money in the bank, or buy back shares, isn’t this firming up their balance sheets, which translates into more stable financial markets where our savings and pension retirement funds are invested? Wouldn’t all this non-invested, saved money create more capital for financial institutions to lend or invest in other companies?

Speaking of employees, let’s not forget that local companies with more money will take better care of their hundreds of thousands of existing employees too, because, hey, the labor market is tight and good people are hard to find and keep. So what will these employees do with their raises and more stable benefits? During the day they’ll shop at Liberty Place and eat at city restaurants. Then they’ll go home each night and buy pizzas, give to charities, visit the mall, and hire contractors, plumbers, electricians, landscapers, and other small businesses to service their residences. All of this spending is fueled by a lower tax environment, both for them and the companies they work at.

Jobs, jobs, jobs. Revenues, revenues, revenues. Will this happen? Of course it will. You have to do something with your cash, even if you’re an evil corporation, right?

Oh, and one final thing about that “tax burden.” Perhaps it’s already high in Philadelphia because we’re funding unrealistic pensions, healthcare, entitlements, and $655,000 retirement payouts to current and former city employees who would never receive these types of benefits if they worked in the private sector. Perhaps this government is telling localities to own up to their own problems and that the federal government is no longer the place to go for financing breaks and credits to rehab houses. Perhaps.

So let’s stop complaining about this “coal in our stocking” GOP tax plan. Sure it’s got its weaknesses — like that $1.4 trillion added to the national debt and the continuing implosion of healthcare. But let’s instead appreciate that money that’s being returned to our local businesses and big corporations will directly and indirectly create more jobs and generate more revenues for the city. Your job, Mayor Kenney, is to figure out how the city can take advantage of all of that.

Gene Marks, CPA, runs a ten-person technology consulting firm in Bala Cynwyd. He writes daily for the Washington Post and weekly for Forbes, Inc. Magazine, Entrepreneur Magazine, and the Huffington Post.