Wolf Proposes Cutting Corporate Tax in Half

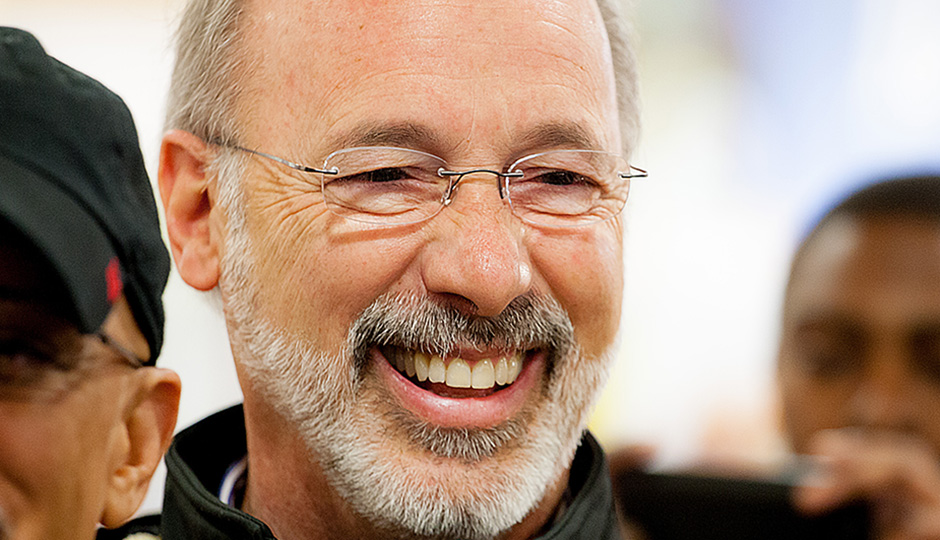

Gov. Wolf. | Photo Credit: Jeff Fusco

Take that, Gov. Rick Scott.

The same week the Florida governor came to Philadelphia to poach businesses — saying his state’s tax structure is less burdensome than the Keystone’s state — Gov. Tom Wolf proposed cutting Pennsylvania’s main corporate tax rate in half.

Wolf, a Democrat, said during a visit to Bethlehem that his first budget proposal next week would seek to reduce the tax from 9.99 percent to 5.99 percent in 2016, 5.49 percent in 2017 and 4.99 percent in 2018.

“The commonwealth can help set the table for robust private-sector growth to create and retain good jobs while strengthening the middle class,” said Wolf, a York County businessman. “In order to create jobs that pay and an economy that grows, we must acknowledge that success will require investment in our companies and our people, and a new business climate that is welcoming and fair.”

PennLive says the effort will be part of a broader “tax fairness plan” Wolf is expected to propose next week, one that also includes a cut to residential property taxes used to pay for schools:

Here’s the anticipated trade-off:

Any new property tax cuts would come as part of a larger overall set of tax increases that would include Wolf’s previously proposed tax on natural gas production plus major hikes in the state’s current 3.07 percent personal income tax, its 6 percent sales tax, or both.

But while overall taxes in Wolf’s proposal may increase, the governor-as-candidate has argued that his reforms – including a new standard exemption for the personal income tax – are designed to lower tax bills for middle- and lower-income households.

“This is a chance for a reset (on taxes).” Wolf told reporters in Dauphin County on Tuesday. “And I hope the people of Pennsylvania like what I propose.”