A Look Into the Philadelphia Real Estate Crystal Ball for 2022

Experts see a slowing buyer’s market and more people getting priced out of Philly as the march toward a majority-renter city continues.

The bidding wars of 2020 have largely disappeared, but houses continue to sell fast in Greater Philadelphia, and inventories remain low. Interest rate hikes, one market professional says, may push some fence-sitters into the market early on but could lead to a more balanced market later in the year. | Getty Images stock photo

Now that 2021 is safely behind us, it’s time to look ahead to 2022. What will drive the Greater Philadelphia residential real estate market in the coming year? Here are three trends that industry insiders say will significantly affect the course of the market in the months ahead.

If the article that follows seems like a continuation of our year-in-review story, that’s no coincidence: The big trends and issues for 2022 all showed up on the radar screen last year.

1) Sales show signs of slowing, but interest rate hikes may push some buyers into the market early in the year. Kevin Gillen, senior research fellow at Drexel University’s Lindy Center for Urban Innovation, has observed some deceleration of the sales pace as 2021 came to a close. In a presentation to the Development Workshop last November, he noted that Bright MLS sales data for November of 2021 showed that new pending home sales had declined 10.3 percent from 2020 levels, and that every county in the eight-county core metropolitan region had posted a decline. Figures for December showed continued declines in every county save Philadelphia.

However, the market might rev up a bit before slowing down further, says David Krieger, president of Coldwell Banker Realty Philadelphia/Central Pennsylvania. “We have seen some increases in interest rates over the last month and a half, and the Fed has committed to increase rates throughout 2022,” he says. “I think that creates an opportunity to get some buyers who are on the fence off the fence and into the marketplace.”

Assuming, that is, that there are houses available to buy. While the bidding wars of the pandemic and early recovery period have largely disappeared, houses still sell quickly across the region: As of year-end, average days on the market remain below 31 in every core metro county save Philadelphia, where houses sell in an average of 39 days. These figures are all below pre-pandemic levels, and also below year-ago levels everywhere but Philly.

And inventories have continued to fall. As of this past December, it would take one month or less to sell every house currently for sale in every county but Philadelphia, where the market would clear in 2.7 months. And inventory levels have fallen 25 percent or more in every county from 2020 to 2021.

What these figures mean is that upward pressure on house prices should continue into the coming year. But Krieger sees a silver lining in this cloud: “There is the potential that as interest rates increase, you have fewer buyers in the market,” he says. “And as listings come on the market, you start to have an increase in accumulated listing inventory, which creates a more balanced market between buyers and sellers.” Real estate analysts consider a market balanced when there is a five- to six-month supply of houses for sale.

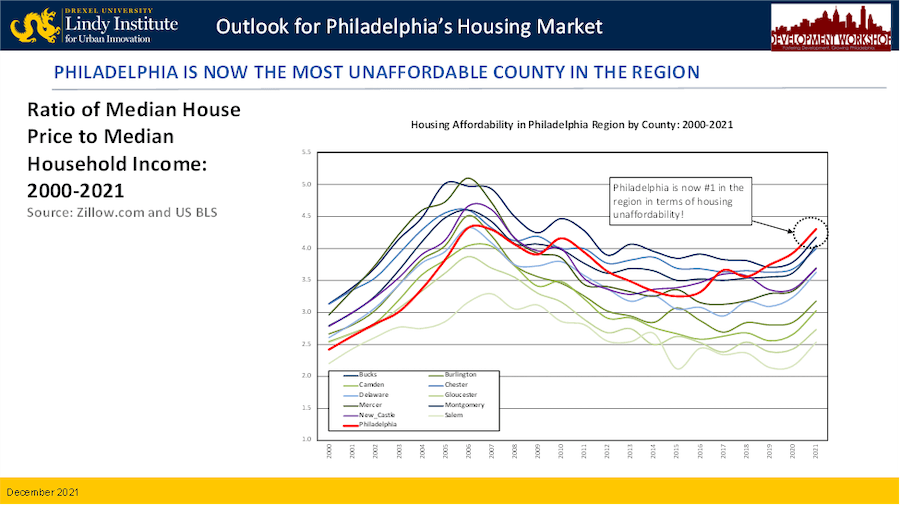

Philadelphia has gone from being the second-most-affordable county in Greater Philadelphia in 2000 to the least affordable county this year. | Chart: Kevin Gillen, Lindy Center for Urban Innovation, Drexel University

2) Affordability moves to center stage for more Philadelphians. Back in 2014, journalist-turned-political-activist Jon Geeting wrote in Next City that Philadelphia had “an income problem, not a housing affordability problem.” But just four years later, a headline in The Wall Street Journal asked incredulously, “You Got Priced Out of … Philadelphia?” as younger Millennials found themselves unable to afford houses in neighborhoods where they wanted to live, such as Fishtown.

Gillen says that the question mark is turning into a period as house prices continue to shoot upward in many city neighborhoods. Gillen, citing Zillow and Bureau of Labor Statistics data, told the Development Workshop in December that Philadelphia is now the least affordable of the 11 counties in the larger metropolitan area that he surveyed: The median-priced house in the city costs about 4.3 times the city median household income, more than in any other county in the region.

“I think affordability is one of the most underreported stories regarding the housing market, but will become an even bigger issue in 2022,” Gillen writes in an email.

In this respect, Philadelphia — which remains one of the more affordable big East Coast cities — is following a national trend. A Real Estate Witch analysis last fall found that house prices were rising much faster than incomes, and that the nationwide average price-to-income ratio had risen to 5.4, double the recommended ratio of 2.6.

Krieger, however, sees the issue as a more localized one, affecting mainly neighborhoods where house prices have risen significantly of late — like Fishtown. “When you look at the neighborhoods on the fringes of Center City, like Fishtown, Kensington, and in years past even Northern Liberties and Pennsport — these areas have seen dramatic appreciation in price per square foot,” he says.

“So in those areas, there are certainly affordability issues that we need to keep our eyes on to make sure that we have affordable housing across the board for folks who want to live in those neighborhoods.”

Alterra Property Group’s LVL North, now under construction at Broad and Spring Garden streets, will add 410 rental apartments to the city’s housing stock when it opens later this year. More new apartments than new condos and houses have been added to the city’s housing inventory every year since 2013, and the trend should continue this year. | Photo: Sandy Smith

3) Philadelphia speeds up its journey toward becoming a city of renters. According to data from RENTCafé, 45 percent of the city’s housing units are renter-occupied and 54 percent are owner-occupied. That’s down more than six percentage points from the 60.5 percent of units that were owner-occupied in 2009 — or a fall of nearly 11 percent.

And for the past decade or so, the pace of construction of new apartments in the city has outstripped the pace of construction of new houses and condos for sale. According to Center City District data, in the neighborhoods the group calls “Greater Center City” — the territory between the rivers from Girard Avenue to Tasker Street — more apartments and condos than single-family homes have been completed every year from 2012 to 2020. And from 2013 on, the number of rental apartments has far outstripped the total for condos and single-family houses combined.

That tilt toward rentals did shrink in 2020 but remained in place. And the delay in implementing the 50 percent reduction in the 10-year property tax abatement — set to begin at the start of 2021 but delayed one year after the pandemic hit — led to a surge in construction permits issued in 2021. More than 1,800 new residential construction permits were issued last year, and Gillen told Axios Philadelphia that if all of the permitted projects break ground in 2022, more than 10,000 new housing units would be added to the city’s housing stock. Given those two numbers, you should be able to figure out what will account for the bulk of those 10,000 units.

And while Building Industry Association of Philadelphia Vice President Mo Rushdy predicts that fewer new permits will be issued in the year ahead because of the tax changes, it’s probably safe to say that rental housing will still account for the majority of new permits issued in 2022. And that means that the transformation of Philadelphia from a city of homeowners to a city of renters will still gain speed this year.