The Trends That Will Drive Local Real Estate in the Year Ahead

The city core and its environs are booming, getting younger, and getting smarter. Are you ready for a Philadelphia that leads the way in a slow-growth region?

The city’s Millennial population has grown 42 percent since 2008, the greatest percentage increase of the nation’s 10 largest cities. | Photo: J. Fusco for Visit Philadelphia

There are some who tout greater Philadelphia as a “Goldilocks” region, economically speaking: Neither flaming nor frozen, it chugs along at a slow but steady pace that’s just (about) right.

But that means that its peers among the country’s 10 largest cities and metros lap it routinely in the race for new jobs and residents. So it might come as a surprise that Philadelphia — and here we’re talking about the city itself — is outpacing other large metros in one key area and doing better than it has in the past in several others.

A younger, bigger, better educated Philadelphia has already led to changes in the dynamics of the local real estate market that should continue in the coming year. Lauren Gilchrist, senior vice president and senior director of research in the Philadelphia office of Jones Lang LaSalle, described the trends that could produce these changes at the annual Urban Land Institute/PwC “Real Estate Forecast 2019” presentation at the Union League on Nov. 29th.

A slow-growth region has a few standout counties

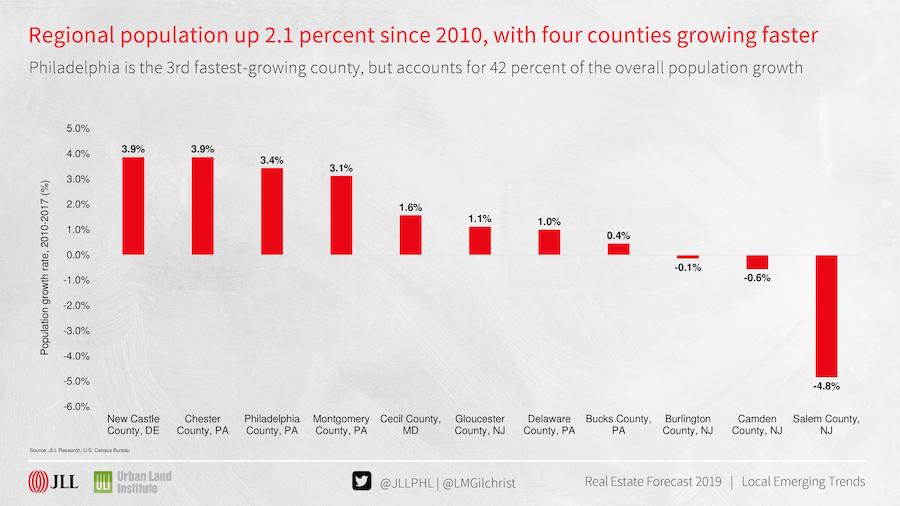

First, however, we should note that the region overall continues to be a laggard when it comes to total economic and population growth. From 2010 to 2016, the 11-county, three-state Philadelphia region has added 14,064 residents each year on average to its population. That’s a 2.1 percent increase over that time span — a smaller increase than any of the other nine largest metros except Chicago.

Likewise, the metropolitan economy has grown by 12.3 percent from 2010 to 2017, a figure that’s below both the national expansion of 15.1 percent and the growth in all but two of the nation’s 10 largest metros, New York and Chicago.

Charts: Courtesy Lauren Gilchrist, JLL

These less-than-impressive figures, however, mask some significant differences within the region in terms of growth. Four counties in particular — New Castle in Delaware and Chester, Philadelphia and Montgomery counties in Pennsylvania, in that order — have posted population growth significantly above the regionwide figure since 2010. New Castle and Chester counties have 3.9 percent more residents, Philadelphia 3.6 percent, and Montgomery 3.1. (By contrast, the three of the four Southern New Jersey counties, Burlington, Camden and Salem, have all lost residents since 2010.)

Philadelphia is the notable newcomer to the local growth game, having finally ended and reversed its five-decade-long population slide within this last decade.

Greater Center City is Philly’s growth locus

And within Philadelphia, the growth story is similarly uneven. Just about all of it is driven by growth in one part of the city. And overall, one generation has contributed a greater chunk of that growth while making the city as a whole a much smarter place.

The part of the city is “greater Center City” and the generation is the Millennial one.

While the growth in the city’s Millennial population has pretty much flatlined since 2012, the spike in the Millennial population during the years of the Great Recession (2008-10) contributed to a 41.6 percent overall increase in Millennials living here. That’s the largest increase of any of the 10 biggest U.S. cities.

And the bulk of those new residents — Millennial and otherwise — have settled in Center City and environs. The population living in the city core has shot up 33.6 percent since 2010, and in the extended Center City neighborhoods (Girard Avenue to Tasker Street) and University City, the population has risen by 20.6 percent. JLL forecasts annualized population growth of 1.8 percent in Center City, 1.7 percent in the extended neighborhoods and 1.3 percent in University City for the period 2010-18. Looking five years ahead, the projected growth rates are 1.5, 1.3 and one percent respectively.

With a population that JLL estimates to be just over 257,000 this year, Greater Center City and University City alone would stand as Pennsylvania’s third-largest city, after the rest of Philadelphia and Pittsburgh.

What’s more, most of these new residents are highly educated. Since 2010, the Philadelphia region has added 108,539 highly educated residents (those with at least a bachelor’s degree) to its population, the fifth-highest total increase of both the 10 and the 25 largest U.S. metros. In percentage growth terms, Philadelphia’s 55.9 percent growth since 2010 is the highest among both.

Apartment glut? What apartment glut?

What this means for the local real estate market is: Building new housing, especially multifamily, in Center City and environs remains a good bet and looks like it will continue to be. Similarly, owners of office buildings stand to gain from sprucing up their properties, as these days, jobs are chasing talent to the places where it wants to live rather than the other way around.

Greater Center City and King of Prussia are, and are likely to remain, the two biggest regional submarkets for multifamily housing in this region. Even a softening at the top of the market in Center City produced by a huge increase in inventory over the last two to three years hasn’t really cut into the demand for dwellings there, and developers who have plans to bring more units on line should have little trouble filling them.

Occupancy rates for apartments in Greater Center City across the board is 91.4 percent, and occupancy rates at the very top of the rental market ($3.50 per square foot a month and up) have rebounded to 83.1 percent in December from 52.6 percent in March. That should bode well for the roughly 1,800 new apartments set to begin leasing in 2019 and 2020.