David Magerman’s Big Plan to Burn Down the Internet

Like a lot of people, Main Line multimillionaire David Magerman believes Google, Facebook and other tech giants are using our private data to manipulate the world. Unlike a lot of people, he’s come up with a radical plan to fight back.

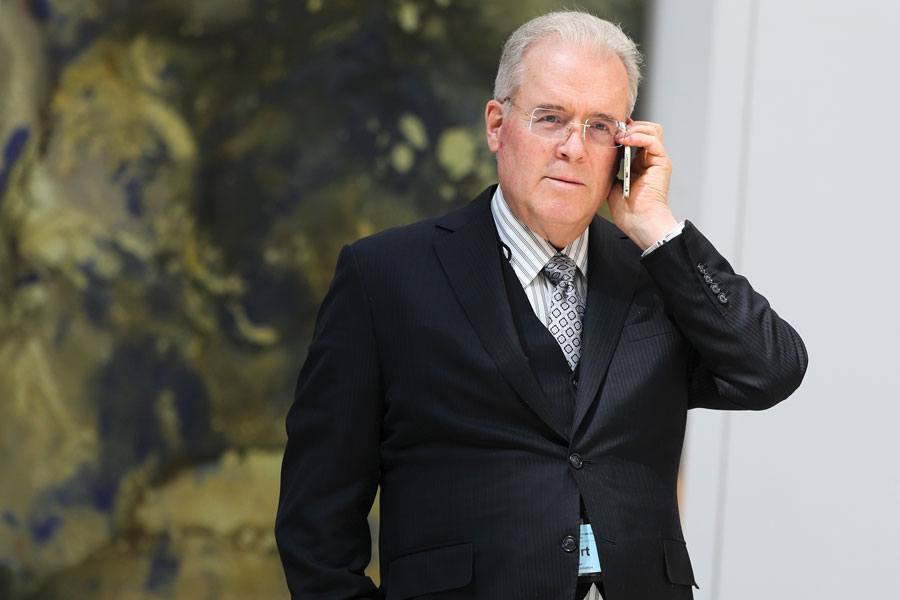

David Magerman outside his 10-bedroom Main Line home. Photograph by Justin James Muir

You’re being watched.

Anything you search, anything you buy online, anything you even consider buying online before your better sense kicks in — an entire constellation of data points is being tracked and sold to advertisers. Whether you support this or resent it is beside the point. Nearly everyone has accepted that this is simply the cost of life online. The advertisers may know us, we tell ourselves, but at least we know they know. It’s easy to become convinced we’re still in control.

But what if that’s just another ad you’ve been served? Surveillance goes far beyond what you search — so far, even, that it’s started to blur whatever difference is left between “online life” and “regular life.” Your Sleep Number bed? It’s harvesting data about your preferences, and maybe even your heart rate. Your Nest thermostat? It’s collecting your data, too. God knows Alexa is keeping tabs on you.

There’s other insidious espionage. Facebook and Gmail monitor your every status and email, mining them for insights that their artificial intelligence algorithms can distill into lucrative personality traits that are then sold to advertisers. The weather app on your iPhone tracks your location and sells it to advertisers. Your health app might be selling information to insurance companies. Even Pokémon Go isn’t immune: Companies pay for poké-placement, drawing unwitting users to their stores like moths to light. This sleight of ad is especially genius: an advertisement that whispers in your ear so quietly that you begin to mistake it for a voice inside your head.

How ironic that in America, of all places — home to what must surely be the largest number of KEEP OUT: PRIVATE PROPERTY signs of any country on Earth — we’ve somehow managed to ignore the fact that data is a kind of property, too. To say privacy is dead is hardly even contentious anymore; what was once hyperbole has been dulled to truism.

Amid this cascading malfeasance, advocates are beginning to raise the alarm that data privacy actually matters, and that the free market of the internet might not have society’s best interests at heart. Among them is David Magerman, a 51-year-old who lives on the Main Line and made millions of dollars developing computer algorithms at Renaissance Technologies, a quantitative hedge fund that, according to Wall Street lore, “solved the market” through its machine learning programs that proved to be better at trading stocks than humans. While most data-privacy people are focused on taking a bat to the likes of Facebook and trust-busting it into pieces, Magerman has other ideas. To truly solve the problem, he says, you have to target the roots: the internet itself.

The internet was actually designed to promote anonymity. The idea was that a decentralized system, open to anyone, would allow individual computers to link together and form the intricate web that comprises, well, the web. Two problems: First, anonymity means you can pretend to be anyone, whether you’re one of the Russians whose troll posts reached a total of 126 million Americans on Facebook alone in the 2016 election; a bank fraudster masquerading as a Nigerian prince; or a newspaper-comments-section crusader. Second, user activity has funneled into a small number of gatekeeper sites like Facebook and Google. The result is a worst-of-both-worlds situation: a diffuse structure that allows abuse by anonymous bad actors, yet simultaneously a centralized one that allows companies to accumulate reams of individuated data, which they can sell to anyone.

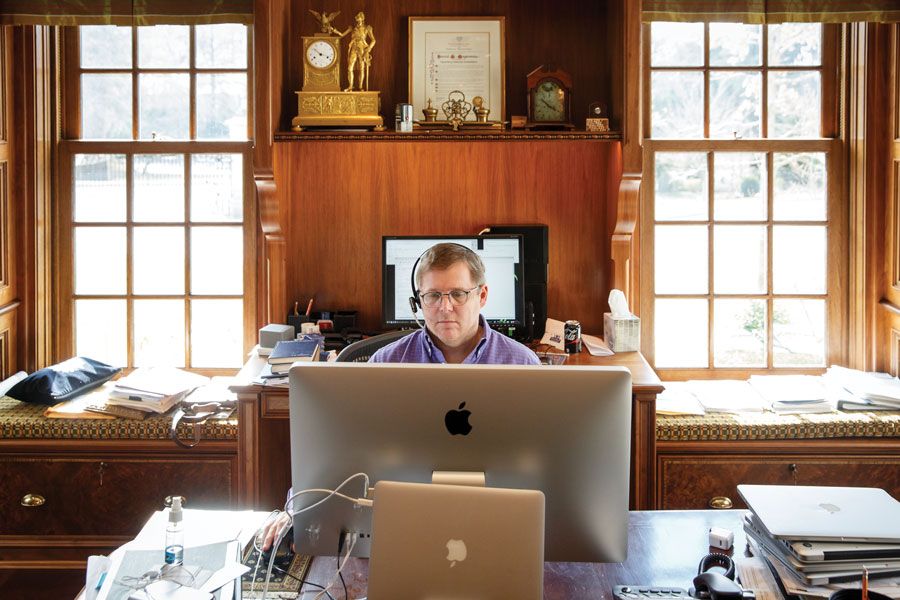

“What I’m really talking about is anti-capitalist,” Magerman, who speaks in warp-speed soliloquies that only seem to end once his whirring brain remembers it hasn’t told him to swallow in a while, tells me. The anti-capitalist sentiment, at first glance, is sort of comical coming from him. Here’s a guy who knocked down a gargantuan 86-year-old classic gray stone Main Line mansion in order to build his own brand-new (and nearly identical-looking) 10-bedroom temple to opulence. He works from home in a wood-paneled office whose furnishings include a copy of the Declaration of Independence once owned by Brigham Young and two gilded antique clocks featuring busts of Benjamin Franklin and George Washington. He drives a Tesla (and has owned every model the company has ever made). Even his appearance evokes a sort of middle-aged status quo satisfaction: slim-fitting blue-and-white button-up shirt, leather sneakers, round wire-frame glasses with transition lenses, a few gray hairs sprouting from otherwise sandy-blond hair.

Of course, these are superficial things. But consider Magerman’s bio, which, far from being countercultural, reads like a parable of American Dream capitalism: son of a cabdriver and a secretary; public-high-school attendee; Ivy League grad; former hedge funder; current venture capitalist; and, most important of all, self-made millionaire (more than a hundred times over).

One of Magerman’s closest mentors was Robert Mercer — the same Robert Mercer who spent $16 million to help Donald Trump get elected in 2016 and who funded Cambridge Analytica, the now-disgraced political consultancy that did work for both the Trump and Brexit campaigns.

There’s another layer to the Magerman message. At Renaissance, one of Magerman’s closest mentors was Robert Mercer — the same Robert Mercer who spent $16 million to help Donald Trump get elected in 2016 and who funded Cambridge Analytica, the now-disgraced political consultancy that did work for both the Trump and Brexit campaigns, claiming it could target voters based on psychological profiles. (Those profiles, it would be revealed, were largely generated from stolen Facebook user data.) After 20 years at Renaissance, in 2017, Magerman — more or less out of nowhere — attacked his erstwhile mentor in the press and promptly got himself fired.

Robert Mercer, David Magerman’s former mentor, in 2017. Photograph by Oliver Contreras/The Washington Post/Getty Images

So if you’re wondering: What gives? How the hell did Magerman the hedge funder turn into Magerman the burn-it-all-down internet privacy reformer? Well, get in line.

Talking about David Magerman with other people isn’t a task for the intellectually insecure. “He learns everything like a computer: He hears it once, it’s memorized, and he does it exactly perfectly every time going forward,” says Nick Adams, his venture capital business partner. “He was just remarkable, the combination of programming speed and talent,” says Mitch Marcus, his mentor when he was a Penn undergrad. “He’s the most intuitive identifier of problems of technical systems that I’ve ever seen in my life,” says Glen Whitney, his former colleague at Renaissance. “He just has an incredible mind,” says Daniel J. Jones, a Magerman confidant who also happens to be the former Senate aide (recently portrayed by Adam Driver in the movie The Report) who authored the seminal review of the CIA’s use of torture in the aftermath of 9/11.

Magerman was precocious from a young age. After his father, fleeing stringent taxi medallion laws in New York City, moved the family to Miami (against his son’s forceful and futile protests), he enrolled in a “gifted” public school. The school, way ahead of its time for 1979, offered a computer programming extracurricular at the local community college — the only place that even had computers. Each week, 10-year-old Magerman would waltz through the doors with his mother, drawing strange looks from the college crowd. “They always thought that I was tagging along and that my mom was taking the class,” he says.

When it came time to go to college for real, Magerman wanted to move back to the Northeast. “I applied to a lot of Ivy League schools, and Penn was the only one I got into,” he says. So he went.

His dad died during his freshman year, and Magerman began seeking out father figures who doubled as mentors, a pattern that would repeat throughout his life. He found his first such mentor in Mitch Marcus, a computer science professor at Penn who worked on using statistics and artificial intelligence to teach computers to understand human language. In Magerman, Marcus immediately saw someone who had not only impressive natural gifts, but also an almost manic work ethic. Each week, Marcus had a standing meeting with his protégé and would assign him what he thought was enough work to tide Magerman over until their next tête-à-tête. “I’d expect to see him in a week having made some progress,” Marcus says. “The next morning, I would come in and David would be sleeping across my doorway, literally blocking my way into my office.” The work was done.

Marcus had no problem providing Magerman with the praise he craved. “David is the brightest, most highly motivated, and hardest-working undergraduate I have seen at Penn,” he wrote in a letter of recommendation upon Magerman’s graduation. Magerman would go on to get his PhD in computer science at Stanford and then got the job that would change his life: a research position at IBM, where he worked alongside two bright coders — two more prospective mentors he could serve — Bob Mercer and Peter Brown. Working on a system that used statistical modeling to translate languages, Brown and Mercer realized that their pattern-spotting work could have a much more lucrative application beyond the Spanish-to-English dictionaries they spent their days poring over. In 1993, the duo joined a hedge fund called Renaissance Technologies. Not long after, they offered Magerman a spot.

A 2017 photo of David Magerman at home. Photograph by Matt Stanley

Magerman wavered about whether to leave the serious research he was doing. But the appeal of using his computer code to handle and tame the real-life stock market, instead of designing some linguistics model that, in his estimation, would inevitably end up “mothballed,” became too much to pass up. The high-roller salary didn’t hurt, either. “My plan was to work there for a few years, make a few million dollars, then go back to academia and maybe use the money to start my own research lab or fund my own projects,” Magerman says. “But that never happened. Making money is insidiously addictive.”

What happens when you lock a bunch of über-smart but awkward computer scientists inside the pressure cooker of a hedge fund? Aside from making billions of dollars, you get a pretty strange work environment, as described in Gregory Zuckerman’s book The Man Who Solved the Market, a biography of Renaissance founder Jim Simons. Once, Simons, who was known to ash his cigarette wherever he pleased (including in underlings’ coffee mugs), was wooing a group of prospective investors at the office when, suddenly needing a receptacle, he popped his smoke smack in the center of a vanilla cake that had been rolled out to celebrate the soon-to-be inked deal. (The returns at Renaissance were so good that even this didn’t scare off the investors.)

Magerman was known to throw occasional temper tantrums — tossing cans of Diet Coke and, once, a computer monitor against the wall. Zuckerman recounts that Mercer, meanwhile, spouted insane conspiracy theories, including once suggesting that then-president Bill Clinton was involved in a secret drug scheme with the CIA. At the time, everyone laughed him off. Mercer was so painfully shy that anytime he said something unrelated to work, no matter the content, it was considered a victory.

Magerman was earning so much money that he felt like a one-man cash-printing central bank. While the stress could be crippling — especially since he was responsible for fixing any bugs in the Renaissance algorithms, which meant being on call at all hours of the night, since the software traded on the international markets, too — it was also thrilling. During this period, the flagship Medallion Fund, which was only open to employees, regularly recorded annual returns of 70 percent or higher. “The idea that I was having an impact on the world that was showing up in the news the next day? It was kind of heady,” Magerman says.

Everyone worked constantly at Renaissance. Magerman rarely left the office, which wasn’t on Wall Street but miles away on Long Island, only adding to the firm’s secretive, fortress-like allure. The company guarded intellectual property like the crown jewels. And why not? Everyone was being paid like kings, even if Magerman hardly knew what to do with his paycheck. “The first time I made a half-a-million-dollar bonus check for six months’ work, I just lost my mind,” he says; he thought to himself, How did this happen?

After more than a decade of self-enrichment at Renaissance, Magerman got introspective: What value was he adding to the world? (Answer: Not much.) Seeking meaning, he took a trip to visit cousins in Israel and soon adopted Orthodox Judaism. He and his wife, Debra, were lonely living in Long Island, surrounded by Renaissance families with whom they increasingly discovered they had little in common. Internal politics at the hedge fund were driving Magerman insane, too. He started to imagine an exit. In 2006, he and his family moved to Gladwyne. Two years later, he quit Renaissance entirely.

If this relocation and religious conversion signaled the stirrings of a more philosophical approach to life, traces of the old Magerman remained. Even when he started donating his fortune — after years of making a “mid-eight-figure salary” — to Jewish causes around Philly, he did it like a bully. “When I started in philanthropy,” Magerman says, “I started effectively buying communal institutions and trying to make them do some of what they were doing, but more of what I wanted them to do.” After a series of high-profile blowups — including a failed effort by Magerman, in his own admission, to “bribe” parents into opposing a merger between Saligman and Barrack, two Jewish middle schools of different denominations — it got to the point where people actually turned down his money.

What happened next was predictable. Flagging in his philanthropic life and waiting out a two-year non-compete clause during which he couldn’t do any quantitative trading, Magerman, who for the first time in his life didn’t have an intellectual outlet for his hyperactive brain, got bored to death. And, frankly, he missed all the money. When the non-compete ran out in 2010, he pleaded with Brown and Mercer to let him return to Renaissance. They were irked that he’d had the gall to leave in the first place, but rather than see him go to a competitor, they brought him back into the fold, letting him work remotely and in a less senior role.

For the next six years, Magerman was happy enough to cash in and stay out of the fray. Then came 2016. He learned that his old mentor Mercer had become one of Trump’s biggest political donors and had introduced Steve Bannon and Kellyanne Conway to the campaign. Mercer had also bought a $10 million stake in firebrand website Breitbart News and invested $15 million in Cambridge Analytica, which boasted about its vast profile database of Americans and its ability to use psychographic profiling to target voters. Magerman was floored. Mercer had always spouted crazy ideas — like the time, Magerman recalls, he suggested the nuclear fallout from Hiroshima and Nagasaki actually made people healthier. “We knew he had wackadoo political views and social views and scientific views,” Magerman says. “It was just a joke until we found out that Bob was doing stuff in the world and acting on it.” Suddenly, those conversations about Hiroshima and drug-running Clinton conspiracies took on a different tenor. (A spokesperson for Renaissance and Mercer didn’t comment on these recollections.)

Magerman realized that Mercer wasn’t your garden-variety Fox News wingnut anymore. He’d become a true ideologue, Magerman says, with a “global mission of deconstructing Western society.” What worried Magerman most: In many ways, he and Mercer were alike — two computer nerds who managed to parlay those skills into massive wealth and become philanthropists along the way. It dawned on Magerman that the combination of Mercer’s wealth and understanding of machine learning uniquely qualified him to turn whatever vision he had for the world into a reality. “The expertise that is necessary for influencing elections is very similar to the expertise that we use for trading at Renaissance,” Magerman says. “I can see that. I’m sure Bob can see that.”

Even before this revelation, Magerman’s conscience had been percolating. “I felt like I’d kind of wasted my life, in terms of not contributing to society,” he says. He came to think of himself as a pawn in Mercer’s support of Trump, having written computer algorithms that helped make Mercer rich. And now Mercer was using that wealth to elect a demagogue.

At first, Magerman didn’t want to burn the whole bridge down. He hoped he could lob a critique in the press limited to Mercer’s support of Trump, clear his conscience, and keep his job. But after he gave an interview to the Wall Street Journal in February of 2017 doing just that, he was suspended without pay. In the weeks that followed, Magerman tried and failed to salvage his relationship with the firm. All of his Renaissance friends — which happened to be most of his friends in general — stopped talking to him on the spot. Speaking out, Magerman says, “destroyed all of the relationships I created with my adult life, and also proved that I didn’t really have any relationships in the first place.”

In April, two months after the Wall Street Journal story, Magerman was officially fired.

There’s a popular cliché about social media that goes like this: Social media isn’t the product — the users are. What does a company like Facebook actually sell? Not its platform, but its data.

In the recent book The Age of Surveillance Capitalism, Harvard Business School professor Shoshana Zuboff argues that the cliché isn’t quite right, though. Facebook users aren’t really the product; they’re more akin to a self-replenishing diamond mine. That is, with each status you write, each private message you send, each photo you post, you’re effectively commodifying yourself — for free! — into an endless stream of precious raw materials that is then mined by Facebook’s algorithms, which in turn hone the secret profiles of you that are then, of course, sold to advertisers. The entire business model is impossible without the massive surveillance and data required to feed the never-satiated appetite of computer AI. This, Zuboff writes, is “surveillance capitalism.”

Ironically, surveillance capitalism used to be abhorred by the very company that invented it. In her book, Zuboff quotes from a 1998 paper published by Google founders Larry Page and Sergey Brin: “We expect that advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers.”

So what changed? The economy, for one. By the time the dot-com bubble started to burst in 2000, Brin and Page had a problem: Their company wasn’t making any money. Google had always mined user data, Zuboff explains, but previously, that information was invested back into the company in the form of service improvements. Now, faced with dwindling cash reserves, Google shifted course, harvesting data for the sole purpose of selling ever-more-detailed advertisements. The gambit worked. In just four years, revenue jumped more than 3,500 percent.

If Google’s foray into surveillance capitalism was born less out of sinister grand strategy than of existential risk, the same can’t be said for Facebook. Sheryl Sandberg, the company’s chief operating officer, realized early on that she had herself a cornucopia. “We have better information than anyone else,” Zuboff quotes her as saying in 2010. “We know gender, age, location, and it’s real data as opposed to the stuff other people infer.” You know how the rest of the story goes.

The incredible success of the Google and Facebook data harvesting machines helped create a new digital advertising ecosystem. This includes the advertising trackers that attach “cookies” to sites all over the web, monitoring your browsing and click history across the internet in order to compile your behavior into a sort of portrait of wants. There are so-called “data brokers,” companies that buy “anonymized” user data from third parties — like, say, information from your Sleep Number bed — and then, through public-records sleuthing, determine your identity and sell the full, individuated profile back to advertisers.

A new business model was invented, too: apps whose sole purpose is to harvest user data. These apps, says Jen King, director of consumer privacy at Stanford Law School’s Center for Internet and Society, “are basically just a front for collecting data.” Maybe an app claims to track your fertility; what it really wants, King explains, is to “sell that data to somebody else who would be interested in it,” like an insurance company doing actuarial analysis on birth rates. It’s not just shady apps getting in on this action. In 2015, IBM bought the Weather Channel app, and — news flash — it didn’t do so to help businesses prep for a rainy day. The motivation was ostensibly to obtain the lucrative location data from the 45 million monthly users of the app. (The city of Los Angeles sued over these practices, alleging fraud.)

The advertising companies that buy data from other apps or track you through cookies are compiling what’s known as “third-party” data. Plenty of researchers are skeptical that targeted ads derived from this data are any more effective than other, less invasive forms of advertising. But when it comes to Facebook and Google — two companies King describes as “giant lockboxes” selling temporary access to their first-person data — experts seem to think the ads really do work. When Facebook announced in 2018 that it would block data brokers from its ad platform, it was less a concession to privacy and more an expression of dominance: The site had so much first-person data of its own to sell to advertisers that the brokers were obsolete.

Magerman’s initial foray into activism was limited to a critique of Robert Mercer’s politics, but he soon began to understand that his former boss was really only a surface ripple of a much deeper problem. Now gainfully unemployed, suing Renaissance over his termination, and with plenty of time (and resentment) on his hands, Magerman dove into researching how companies like Cambridge Analytica really worked. He funded investigations into election interference both in the United States and abroad. He learned, along with the rest of the world, after a 2018 New York Times investigation, that Cambridge Analytica had secretly harvested the data of 50 million Facebook users without their consent or knowledge, as part of its quest to build more psychological profiles. (By then, Magerman had deleted his own account.)

“Data is being mined for information,” Magerman says he concluded. “People are being modeled, and anything from companies to candidates are shaping people’s opinions and pushing them to have certain views.” The idea was that if you knew someone’s personality, you could refract your messaging accordingly. Say you were in the business of election meddling: You could persuade a conservative ideologue to vote by suggesting his way of life was under threat, and you could similarly dissuade, say, a disaffected Bernie Bro from voting by suggesting the system was corrupt. This was the true source of Cambridge Analytica’s power, just as it was the lifeblood of Google and Facebook. He had seen the light: Magerman the capitalist was now Magerman the anti-surveillance capitalist.

He was far from the first person to understand this, but he didn’t waste any time in trying to solve the problem. In 2018, he founded (and funded, to the tune of $425,000) an advocacy group called “Freedom from Facebook” that promoted breaking up the social media behemoth. Magerman also came to believe that though certain jurisdictions had successfully passed privacy legislation — like the European Union’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act — wholesale reform in the U.S. was unlikely.

“There’s a lot of lobbying and financial interest in maintaining the status quo,” Magerman says. In 2018, corporations spent $108 billion on digital advertising, outpacing print and television. Just the location services advertising industry, according to one analysis, is a $21 billion annual market. There’s an entire cybersecurity industry that also, rather perversely, depends on the insecurity of the current system. When Magerman started thinking about ways to solve the data-privacy problem, he determined the only true solution would be to fundamentally re-create the internet.

When Magerman started thinking about ways to solve the data-privacy problem, he determined the only true solution would be to fundamentally re-create the internet.

Here’s how: Right now, Magerman believes the internet has both insufficient data encryption and too much privacy. He proposes creating a new, public layer of the web that would also protect data, inverting the current model of a private system that enables mass data collection. On Magerman’s internet, data would be automatically encrypted by a third party, meaning Facebook wouldn’t be able to access yours unless you voluntarily gave it the key. Additionally, anyone surfing this new internet would need a sort of internet driver’s license: If you wanted to participate in what Magerman conceives as mainstream society — online banking, social media, email — you’d have to be a verifiable human. And what of the “old” anonymous internet? It would still exist, Magerman says. You’d simply be opening yourself up to data collection if you chose to browse there.

There’s still plenty to work out. Who would the third-party encryptor be? How to ensure it’s actually neutral? What to do about other countries, since the internet is international? Magerman asks these questions, leaving some unanswered, in a white paper he published and shared with internet-privacy advocates in May of last year. But before anyone can start figuring out who would buy into Magerman’s new infrastructure, he has to prove he can actually build it. He says that will happen soon: In May, he was in talks with two groups, a tech incubator and a like-minded data privacy reformer, about building a prototype. Magerman plans to invest one or two million dollars in the project — with, he hopes, millions more in outside funding.

David Magerman. Photograph by Justin James Muir

Magerman’s as-yet-nonexistent internet has its critics. Elizabeth Renieris, a fellow at Harvard’s Berkman Klein Center for Internet & Society, says tearing down the whole infrastructure before we even try to regulate it is too brash. “We are only using one to two percent of our legal toolkit in terms of enforcing the full array of regulatory options available,” she says. Not to mention that centralized oversight could create an infrastructure of mass surveillance not unlike the one that exists in China.

Magerman has heard that last counterargument, and he’s not convinced. “If you’re choosing to live your life on Main Street,” he says, “the social contract dictates that you give away some of your freedom. We do it already in our everyday life. If I want to get a cell phone, I have to give three forms of ID. But for some reason, I can get a social media account with nothing.” At any rate, Magerman thinks the stakes are too high to wait for regulation. Companies like Cambridge Analytica have already proven, he says, that “they can do things like convince people to vote for Brexit or convince people to vote for Trump.”

“If I want to get a cell phone, I have to give three forms of ID,” says Magerman. “But for some reason, I can get a social media account with nothing.”

I raise the point that plenty of observers believe Cambridge Analytica was nothing but a bunch of sophomoric psychobabble that actually influenced nothing. Magerman shoots that down. “They’re wrong,” he says flatly. “And the reason I know they’re wrong is because Bob Mercer knows very deeply how powerful this technology is. There’s no way he would invest in it. He would know if it worked or if it didn’t.”

When it comes to reconfiguring one of the most significant, ubiquitous inventions of the past hundred years, it’s safe to assume there are least two required ingredients: time and money.

Magerman has one but not the other. See, he still has his day job in venture capital, which he balances alongside his continued Jewish philanthropy, owning two local kosher restaurants, Citron & Rose and Zagafen, and having a fourth-grader, an eighth-grader, a high-school senior, and recently a displaced college student at home. (Magerman says he sleeps, though I’m not entirely sure he’s telling the truth. After we first met, I received a follow-up from him at 3:16 a.m.)

Magerman doesn’t dislike his current job, but he says he doesn’t feel like a venture capitalist. He’s always been most comfortable cast as the mechanic, fine-tuning technology behind the scenes. But he’s a VC, so the technology is the one thing companies won’t give him access to. “Even when I’m an investor,” he says, “they’re still not going to tell me the secrets.”

Do you see where this is going? Magerman is getting restless again — maybe even bored. One day, back when it was still possible to see other people in person, we were walking to his car after meeting with a group of four baby-faced Penn students who’d started a company — it involves software that annotates legal contracts — Magerman thought might be worthy of investment. I asked him point-blank: Are you intellectually stimulated in your current job?

Magerman let out a hmmph. “No,” he said. “That’s the one frustrating thing about my work. I’m using a fraction of my brain.”

Sometimes, he misses working for a quantitative hedge fund. But when he settled his lawsuit with Renaissance in 2018 and his disdain for the industry was still fresh, he made sure he couldn’t go back, shackling himself to a stringent 10-year non-compete clause that effectively barred him from the whole field. It wasn’t just a symbolic act of repudiation. He wasn’t sure he’d be able to stay away: “I didn’t trust myself.”

Sure enough, not long ago, in a moment of weakness, Magerman pulled out the old agreement. “Don’t tell my partners this,” he says sheepishly, “but I was looking and seeing how I could be making a lot more money. I could be doing some of the venture stuff while also working part-time for a quantitative hedge fund and engaging my brain.” Alas, the shackles held firm.

Even Magerman would probably admit that’s for the best. He’s already cloaked in cognitive dissonance, advocating for the regulation of capitalist institutions like Facebook and reconstructing the internet while working at a venture capital firm that invests in, among other things, cybersecurity and artificial intelligence. A return to the quantitative hedge fund industry — the same industry in which Bob Mercer is still employed — might very well shatter the image he’s cultivated as an enlightened reformer. (And Magerman hasn’t entirely shorn himself from Renaissance, either. In settling his lawsuit, he earned the right to remain an investor in the firm’s Medallion Fund.)

Still, Magerman is feeling antsy. “I fear that at some point in the near future, I’m going to want to dive into technology,” he told me in early March. That was before the COVID-19 pandemic had dismantled society, which prompted a reckoning of sorts. Something that would have triggered a five-alarm fire in his head (phone companies teaming up to assist with contact tracing) he now accepts as necessary. And another life-altering shift: He rejoined Facebook (though only, he insists, to connect with people in need during the crisis). But these aren’t signs of philosophical wavering on Magerman’s part — far from it. If anything, the pandemic has only strengthened his resolve. If his new internet already existed, he says, then these temporary invasions of privacy would be just that: temporary.

There are other developments that might further push Magerman toward his internet project. The 2020 election is around the corner, and while Cambridge Analytica is bankrupt, a number of players (including Trump’s campaign manager, Brad Parscale) still have ties to the firm. Meanwhile, Bob Mercer, after dropping off the political map during the 2018 midterms, is back. In April, he donated $350,000 to a group supporting Trump’s reelection. Magerman wasn’t surprised: “This is what people with money do,” he says. “They invest their money for returns of different sorts.”

Still, Magerman hasn’t yet fully invested in his reform plan. That’s partly because he doesn’t want to quit his VC job after just two years and leave his partners out to dry. But there may be other considerations: Right now, Magerman is in the rather comfortable position of being a benefactor to activists, rather than an actual working activist himself. To fully commit to his new internet — and to truly close the book on hedge funds and venture capital — is also, in a way, to repudiate the person he has been for his entire adult life.

When I initially met Magerman, he told a story about one of the first times he became suspicious of psychological targeting. This was in 2014. He and his wife used to play Bejeweled, a Tetris-style matching game on Facebook, and without fail, David would get crushed. He couldn’t understand it. One day, he ended up in front of his wife’s computer and logged in on her account for a quick game. Out of nowhere, he says, his score quadrupled. I have no clue whether what follows is true, but this is the conclusion Magerman came to: The game must have been scoring contests on his account lower than on his wife’s, in an attempt to keep him playing and coming back for more.

Somehow, he thought, the game had learned something fundamental about him: “I am the kind of person who will keep challenging myself and pushing, pushing, pushing until I succeed,” he says. “Once I’ve won, I’m satisfied.”

Published as “The Goliaths” in the June/July 2020 issue of Philadelphia magazine.