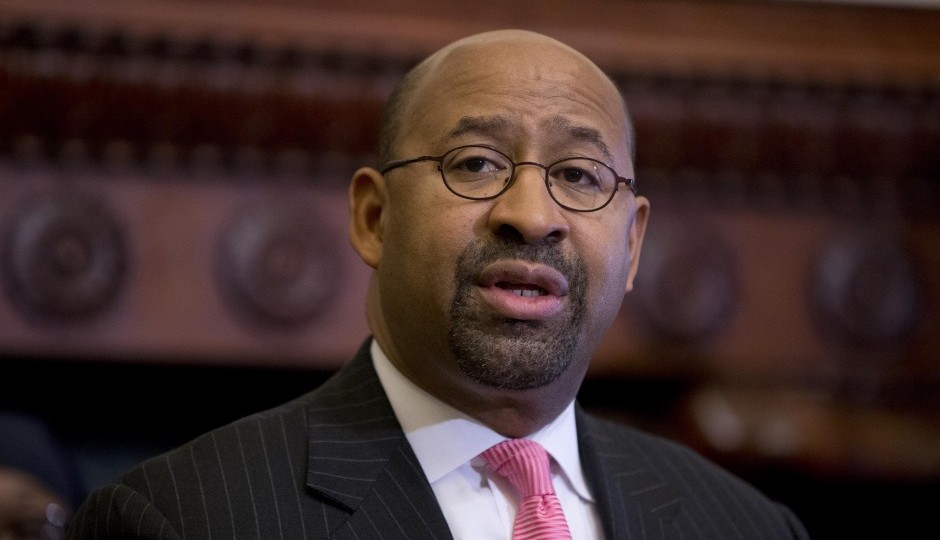

5 Things Michael Nutter Wants You to Know About His Property Tax Hike

Mayor Michael Nutter proposed a budget Thursday that would total $3.95 billion, expand the use of police body cameras, most likely eliminate the need for a tuition hike next year at the Community College of Philadelphia, and increase spending on the city’s long-underfunded Licenses & Inspections department.

But all eyes went to only one part of his plan: a 9.3 percent increase in property taxes. Nutter wants to use that to give $105 million to the city’s cash-strapped schools.

Under Nutter’s proposal, the city’s property tax would go from 1.34 percent to 1.47 percent.

At his budget address before City Council, Nutter began what will inevitably be an intense lobbying effort in a year in which almost all of Council is up for reelection. As if that wasn’t hard enough, his property tax proposal comes not long after a controversial citywide reassessment raised property taxes for some.

“Let me say this very clearly,” Nutter said. “I don’t want to raise your taxes. But I do want to educate your children.”

Here are five other key points Nutter made about his proposed property tax hike:

- If Gov. Tom Wolf pushes his budget through the GOP-controlled state legislature, the average Philadelphia homeowner’s property tax bill would actually drop in 2017, Nutter said, even if he gets his tax hike. Wait, how does that work? Wolf plans to provide hundreds of millions of dollars in tax relief to Philly, which would be paid for by statewide increases to sales and personal income taxes. Wolf wants to use some of that tax relief to almost double the city’s homestead exemption. The upshot: “The 2017 tax bills would be, on average, $287 less than 2015 residential property tax bills,” Nutter said.

- Nutter said he is “sensitive” to the fact that some Philadelphians saw their property tax bills go up following his citywide reassessment, known as the Actual Value Initiative. But he said that while 30 percent of property owners saw increased tax bills under AVI, 70 percent saw their tax bills stay the same or decrease.

- To be sure, the city has raised taxes more than once under Nutter’s tenure. But Nutter said that he has not proposed a tax increase in his budget for the city’s general fund in since 2011. “We have managed our city funds well these last few years,” he said.

- For those who question why Nutter isn’t proposing major budget cuts to fund the schools, he said, “It’s not like we have excess services. We’ve made a lot of cuts over the past number of years.” For those who question why he wants to raise funds through the property tax instead of, say, a business tax, he said, “Education funding needs stable, dependable, recurring funding. … The property tax is one of the most stable, dependable, recurring funding sources. … In my view, it’s the most straightforward path.”

- Sometimes it seems like the city will never stop increasing taxes to fund the schools. Nutter said that the school district has had to ask for more money over and over again in the last few years because the state and city have never fully met their budget requests. If the Wolf and Nutter budgets both passed, the mayor said that would put the district on a “path to financial stability. … This Tuesday, Wednesday and Thursday, I think have been a seismic shift in what public education is supposed to be about.”

Now, will Council buy these arguments? Check our Citified blog for analysis.

Follow @HollyOtterbein on Twitter.