Today’s First-Time Homebuyers Are Late Bloomers Compared to Those From Decades Ago

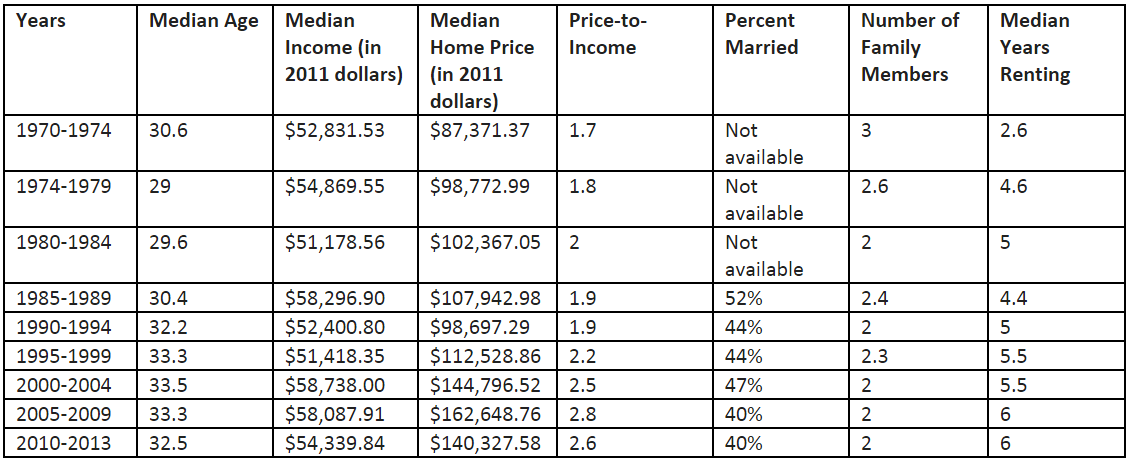

Know any millennials still on the rent bandwagon and with little to no aspiration to buy a house any time soon? It would be surprising if you don’t. According to a new Zillow report, first-time homebuyers tend to rent for an average of six years before signing off on a mortgage and are likely to be older, single, and spending a larger portion of their income compared to first-timers in the 1970 and 80s.

Indeed, if you want to get number-specific, first-time homebuyers from the 1970s rented for an average of 2.6 years, almost three times less than they do now. Moreover, they bought homes for about 1.7 times their income, while their millennial counterparts go for houses that cost 2.6 times their annual income. Age-wise, the 1970s and 80s saw its first-timers at 29 and 30 years old; today, the average first-time homebuyer is 33.

So, what exactly is behind this postponement by today’s young grown-ups? Dr. Svenja Gudell, Zillow’s chief economist, attributes it to a general slowing down in life milestones: “Millennials are delaying all kinds of major life decisions, like getting married and having kids, so it makes sense that they would also delay buying a home,” she says.

No kidding. The 1980s saw 52 percent of its first-time homebuyers as married couples. Now, only 40 percent are legally attached when acquiring their first residence.

Below, a Zillow chart offering a glimpse at first-time homebuying stats through the years.