Against Philly’s Wishes, Pa. Inches Toward Property Tax Reform

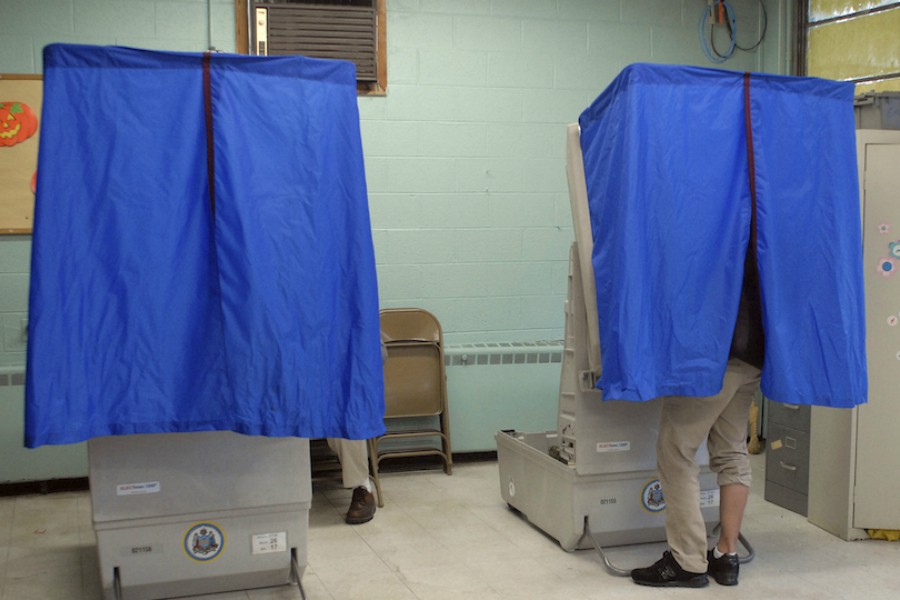

Pennsylvania voters approved a ballot question that essentially paves the way for reduced property taxes – which Philly residents largely opposed.

Those who exercised their democratic right in Pennsylvania yesterday had the chance to answer the following ballot question:

Shall the Pennsylvania Constitution be amended to permit the General Assembly to enact legislation authorizing local taxing authorities to exclude from taxation up to 100 percent of the assessed value of each homestead property within a local taxing jurisdiction, rather than limit the exclusion to one-half of the median assessed value of all homestead property, which is the existing law?

Maybe you went to the polls prepared and, having done your research, understood the question. If that’s not the case, you should know that it essentially asked if voters wanted to amend the state constitution to allow Pennsylvania legislature to permit school boards, municipalities, and counties to exclude local properties from taxation.

On the whole, Pennsylvania voted yes. This means that local taxing bodies could significantly reduce (or eliminate) property taxes in their jurisdictions, paving the way for a notable reduction in the state’s dependency on that revenue. But it’s important to note that the referendum only made that adjustment possible: it doesn’t cause any immediate changes to property taxes or to the state constitution.

In fact, as the Committee of Seventy points out, local taxing bodies have been able to exclude up to half the median value of homes in their area from taxation since 1997, but few have actually done so. Why? Because school districts, municipalities, and counties rely on that revenue source – including Philadelphia County, where at least 60 percent of residents voted “no” to the ballot question, according to unofficial election returns.

The referendum did not suggest an alternative funding supply to replace property tax revenue, a primary source of funding for the School District of Philadelphia and for schools and municipalities across Pennsylvania. For state lawmakers to pass a bill amending the Pennsylvania Constitution to allow for a reduction in property taxes, the legislation would likely have to include a plan to balance the potential funding cuts.

Gov. Tom Wolf has pushed for property tax reform in the state, where property tax collections account for roughly 30 percent of local and state tax revenue, per the Tax Foundation.

Statewide, nearly 54 percent of voters approved the measure, per unofficial vote tallies.