The No-Bullshit Guide to the 2016 Pennsylvania Budget Battle

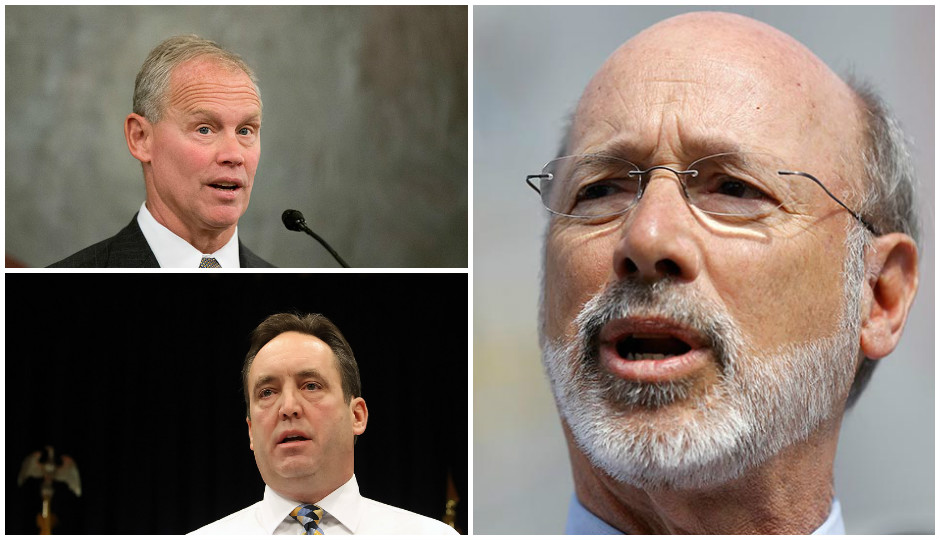

Clockwise: House Speaker Mike Turzai, Gov. Tom Wolf and Senate Majority Leader Jake Corman. | Photos by Matt Rourke and Chris Knight/AP

It’s budget season once again in Harrisburg. Or more accurately, it’s still budget season. Gov. Tom Wolf and the Republican leaders in the state House and Senate have been negotiating—and failing to negotiate—over taxes and spending since Wolf laid out his first budget proposal in early 2015.

It took more than a year after the governor gave his first budget address for an actual spending plan to become law, and that only happened without Wolf’s signature. Lawmakers passed last year’s budget nine months after the June 2015 deadline, the longest budget delay in modern Pennsylvania history. And by the time it was settled, Wolf had already proposed his budget for the next year.

Now the due date for a new financial plan is fast approaching. Will state lawmakers meet the deadline? Or will they blow it like last year, leaving school districts and nonprofits across the state in the lurch? Here’s everything you need to know:

When is the state budget due?

By law, legislators have to pass a new budget by midnight on Thursday, June 30th, 2016. The new fiscal year starts on July 1st.

Right, but when is it really due?

Whenever it’s ready! Really, legislators don’t suffer any consequences as a direct result of failing to meet the budget deadline. But the state sometimes does. During last year’s budget impasse, schools were forced to borrow money while funding was frozen, and Pennsylvania’s credit rating was downgraded, making it more expensive to sell bonds and borrow cash.

Of course, bad news like this catches up with lawmakers eventually … right? Democracy does work, right? After all, 2016 is an election year. Well, maybe. Last year, a new Democratic governor was facing a Republican-controlled legislature. Both sides had major incentives to stick to their guns and show their strength. Wolf crushed Republican incumbent Tom Corbett in the gubernatorial election in 2014 and probably wanted to take his perceived mandate out for a spin. Meanwhile, Republican lawmakers wanted to show the new governor who still holds the cards.

Now, with much of the legislature facing voters in November, the incentive shifts ever-so-slightly toward showing that the state government is functioning. A January poll found that Pennsylvanians’ approval rating of Wolf and the General Assembly had hit record lows, with more voters blaming the legislature than the governor.

“It would be great to have it on time,” Wolf said in a radio interview on Tuesday. “I think everybody would love to have that. But I think we also want a good budget.”

What did Wolf propose this year?

In February, Wolf delivered his budget address to the legislature. But the fight over the previous year’s budget was still ongoing, so Wolf spent most of his speech reminding his colleagues that the financial sky was falling—the state faces a $2 billion structural deficit, according to Wolf—rather than outlining his spending and revenue plans for the new year.

The budget proposal itself called for $33.3 billion in spending, including $3 billion in new tax increases. Wolf wanted to raise additional money by increasing the income tax from 3.07 percent to 3.4 percent, eliminating exemptions to the sales tax, and raising the cigarette tax by a dollar a pack, while taxing additional tobacco products to the list of those that are taxed. He also re-proposed a tax on natural gas, which Republicans in the legislature have consistently opposed.

Under Wolf’s plan, an extra $200 million was to be directed to schools, on top of the millions Wolf had proposed for additional education funding in the previous year’s budget. Wolf also wants to spend an extra $34 million to help battle heroin and opioid addiction in Pennsylvania. And he spent much of his budget address stressing the importance passing a balanced budget. So those three things—investing in schools, fighting the addiction epidemic, and passing a balanced budget—have been Wolf’s stated priorities this year.

Where do negotiations stand now?

A remarkable thing happened a few weeks ago: The state House passed a (modest) liquor reform bill that would allow wine to be sold in certain grocery stores, and Gov. Wolf signed it into law. Was it a breakthrough in political cooperation? A harbinger of happy days to come?

We’ll see. On Monday night, a House committee passed a spending plan of its own in a bipartisan vote of 36-1. The full House approved that proposal on Tuesday night. The bill will now go to the Senate, which is likely to make some amendments and then reconcile the bill with the House before delivering it to the governor.

The House proposal calls for $31.55 billion in spending (almost $2 billion less than what Wolf wanted). While lawmakers are still debating how to raise money for that plan, the conversation currently seems to be revolving around increasing taxes on cigarettes and certain other tobacco products—not cigars—and obtaining new revenue from expanded online gambling and liquor sales. It would deliver $15 million for fighting opiate addiction, rather than the $34 million Wolf asked for, according to reports. It would also increase education funding by $200 million rather than by $250 million, as Wolf proposed. Wolf said in a radio interview on Tuesday that he hasn’t yet agreed to the House proposal, and is concerned that it isn’t balanced.

Wolf lambasted lawmakers during his budget address for appearing to “balance” the budget with one-time revenue sources, which would leave some programs unfunded in future years. A budget that has an ongoing gap between money going out and money coming is said to have a structural deficit, and Wolf has been pushing lawmakers this year to pass a budget that accounts for all spending with stable revenue.

“[The House bill] may pass and it may go to the Senate,” Wolf told KQV-AM in Pittsburgh on Tuesday. “If it does, let’s hope the Senate fixes it.”

Still, that’s a change of pace from last summer, when Wolf was promising vetoes of Republican-backed budget proposals. And negotiations appear to be proceeding more productively than we might have predicted, given that Republicans were gearing up for a nasty fight in April.

In a conversation with Philadelphia magazine on Tuesday afternoon, Wolf spokesman Jeffrey Sheridan was non-committal, saying no final deal has been reached and negotiations are ongoing. He said Wolf had been in meetings with leaders of both parties in the House and Senate as well as with members of the Philadelphia delegation. Meanwhile, on Monday, conservative Republicans held a process conference to protest that they were being shut out of the budget negotiations.

Officials said it won’t be clear how much money the Philadelphia School District will receive from the state until the budget is finalized. A district spokesman didn’t immediately respond to questions about its funding allocation from the state, and Sheridan said he didn’t want to say how much Philly schools might get, pending final budget negotiations.

What’s happening with pension reform?

Last year, Republicans made liquor reform and pension reform central priorities in their negotiations over the budget. Now that some type of liquor reform has passed, where do the pension negotiations stand?

So far, despite being controlled by the same party, the House and Senate haven’t seen eye-to-eye on pension reform, though both have pursued plans that would make public pensions more like those in the private sector. Earlier this month, the House passed legislation of its own that would give state employees a hybrid pension plan and limit the state’s contribution. Wolf has said publicly that he’ll sign either the House or Senate version of a pension-reform bill.

Still no fracking tax, huh?

Well, anything could still happen—it often does in the last days before a budget deal—but it doesn’t look like a tax on natural gas extraction is going to pass this year. Increasingly, it appears that the Corbett administration was a successful filibuster on that idea. Wolf proposed a 5 percent extraction tax in 2015. Lawmakers declined to pass any version of that, so Wolf upped his proposal in 2016 to 6.5 percent. That tax doesn’t seem to be a serious part of the negotiations, and the fracking boom is already fading.

So, what next?

What indeed! Now that the House has adopted its own spending proposal, the Senate will take up the plan, presumably under pressure to make sure all the spending is paid for. Wolf and his team are also likely to keep negotiating with Senate leaders for more money for schools and addiction services. The Senate can amend the bill and then reconcile it with the House, before passing it on to Wolf for final approval.

Will all of that happen before the Thursday night deadline? And what last-minute shenanigans and horse trades will ensue?

Stay tuned.

Follow @JaredBrey on Twitter.